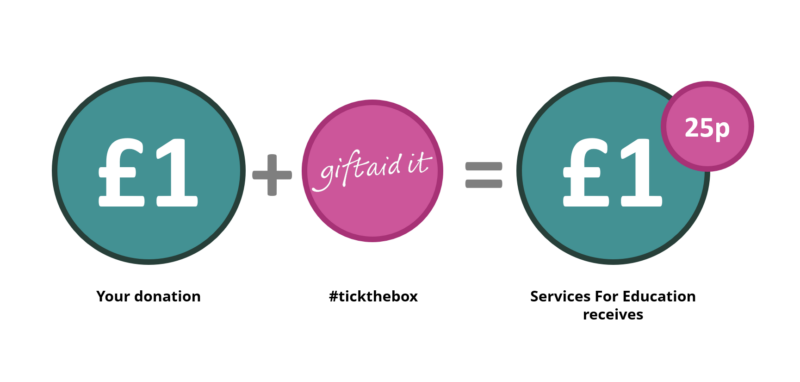

Every donation you make to Services For Education could be worth more, at no extra cost to you, just by choosing to Gift Aid it.

For every £1 donated with Gift Aid, Services For Education will receive an extra 25p from the government. So, for example, if you donate £20 we can claim an extra £5, making your gift worth £25.

You simply need to have paid or will pay an amount of income tax and/or capital gains tax that is at least equal to the tax that Services For Education and other charities and Community Amateur Sports Clubs you donate to will reclaim on your donations in a tax year.

This additional income really does make a big difference, so please don’t forget to Gift Aid if you are a UK tax payer.

Use our Gift Aid calculator to see how Gift Aid can boost your donation.

Please note, if you donate through CAF you need to #tickthebox to enable us to claim Gift Aid on your donation. If you’re a regular donor, you will need to ensure you are registered for Gift Aid in your CAF account.

If you are a UK tax payer and would like your donations to go further, please complete our online Gift Aid Declaration form.

Please contact [email protected] if you want to cancel or amend this declaration, if you no longer pay sufficient Income Tax and/or Capital Gains Tax, or if your address changes.