Did you know that if you #tickthebox to add Gift Aid to your donation, it means your donation grows by 25% – at no extra charge to you?

In this blog, we talk you through the Gift Aid process and how it can help us as a charity.

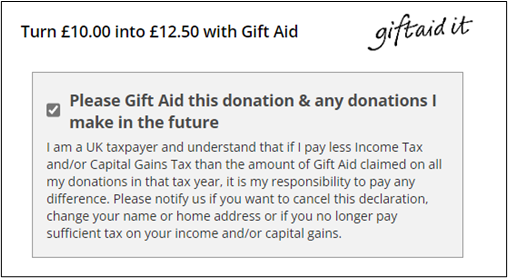

By ticking the box, you enable us to claim a further 25% from HMRC, meaning a £5 donation would be worth £6.25, and £10 would be worth £12.50.

Although that extra £2.50 may not sound a lot, it really does add up and each time an eligible taxpayer donates and doesn’t tick the box, we miss out – last year we missed out on nearly £1,500 in this way, which could have made a big difference to the work we do.

In order for us to claim Gift Aid on your donation, you just need to #tickthebox and provide some basic personal details when making your donation. As a donor, you must have paid UK income tax or capital gains tax in the year, at least equal to the amount of tax we will reclaim on your donation.

If you have donated to us in the past, but didn’t tick the Gift Aid box, don’t worry. You can use the link below to complete a declaration form which will enable us to claim Gift Aid on any past, and future, donations.

Please note, Gift Aid can only be claimed on personal donations, so any money raised through fundraising events (excluding sponsorship) or from a company donation isn’t eligible for Gift Aid.

If you have any questions, please don’t hesitate to contact the team at [email protected]

About the Author

Sarah Caldwell – Fundraising Manager, Services For Education

Sarah Caldwell joined Services For Education in Summer 2023, bringing with her over 14 years fundraising experience. Working in the Birmingham charity sector, she has raised valuable funds for a range of projects impacting the day to day lives of young people with disabilities.

Sarah has experience across a number of fundraising streams (including Trusts & Foundation, Events and Corporate Fundraising), and brings this, along with a strong interest in building relationships with supporters, to her role at SFE.